In the world of construction, success is often determined by meticulous planning, execution, and following deadlines. For contractors and construction suppliers in Florida, one of the most critical aspects of the job is understanding and adhering to the 90-day lien deadline. This inflexible timeframe is a linchpin for financial security, and this blog post delves into the importance of this deadline, its calculation, and the dire consequences of failing to meet it.

Understanding the 90-Day Lien Deadline

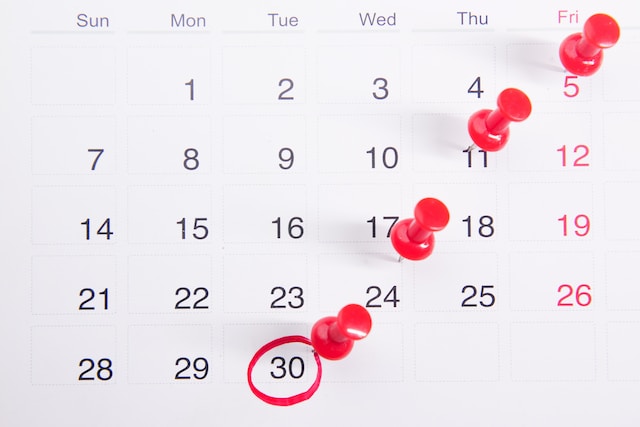

The Florida 90-day lien deadline is not a mere suggestion; it’s a legally mandated, absolute rule. The significance of this timeframe arises from the fact that it represents the last opportunity for those involved in construction to claim a lien for their work. If a contractor or supplier fails to file a construction lien within 90 days, they are almost always barred from doing so afterwards. The clock starts ticking from the date of final furnishing of labor, services, or materials, leaving virtually no leniency.

The Consequences of Missing the Deadline

To emphasize the gravity of this deadline, let’s consider a real-life example: a construction company that placed undue trust in an owner’s promises of payment. Eager to maintain a positive working relationship, the company opted to delay filing a lien, trusting that their client would eventually fulfill their financial obligations. However, the owner failed to deliver on their promises, and by the time the construction company realized, the 90-day deadline had irreversibly lapsed. They had lost their right to secure their payment through a lien, and were left with the remedy of a vanilla breach of contract claim.

Here is the issue: pursuing a breach of contract lawsuit is significantly more difficult than a lien foreclosure lawsuit. With a lien, the contractor has the advantage of using the property itself as financial security, which serves as a powerful incentive for payment. Furthermore, the Florida lien statute empowers the prevailing contractor to recover their attorney’s fees, a benefit that may not be readily available under the contract.

The Importance of the Property as Financial Security

It’s worth reiterating the crucial role of the property in lien foreclosure lawsuits. When a contractor files a construction lien, the property where the work was performed becomes a form a financial security. If the contractor is successful, the property can be sold to settle the debt, ensuring that the contractor gets paid. Whereas, in a regular breach of contract lawsuit, the contractor might win the case, but still find that the owner is unable to pay the judgment.

Closing

In sum, the 90-day lien deadline in Florida is an absolute and unforgiving rule that all construction professionals must adhere to. Failing to meet this deadline can lead to the loss of valuable financial security and a more arduous legal battle. Trusting promises of payment without securing your rights can be a costly mistake in the construction industry. So, always remember, in Florida, time is of the essence when it comes to construction liens.

DISCLAIMER: The information provided on this website does not, and is not intended to, constitute legal advice; instead, all information, content, and materials available on this site are for general informational purposes only.